"Slash and sell" by By Chris Moye, Kenza Bryan for Global Witness

"Mark Carney firm offloaded farms linked to deforestation and human rights abuses in hypocrisy-ridden 'slash and sell' strategy"

The following is the first of two investigative reports published on the Global Witness website regarding Brookfield Asset Management which Mark Carney once helped to operate as an allegedly “green finance” champion.

Slash and sell

How financial giant Brookfield and its big bank backers profited from deforestation and the abuse of Indigenous Peoples’ rights in Brazil

By Chris Moye, Kenza Bryan for Global Witness

November 8, 2022 – Updated: 16 December 2022

A Canadian asset manager part run by green finance champion Mark Carney cleared thousands of football fields worth of tropical forest in Brazil, our investigation can reveal

An estimated 9,000 hectares (ha) of deforestation, the legality of which could not be proven by Brookfield Asset Management, took place on eight farms owned and managed by Brookfield’s soybean farming empire.

The forest clearance took place in the Cerrado, Brazil’s tropical savannah, between 2012 and 2021, according to analysis of satellite imagery from Brazil’s space institute, before the properties were sold off in late 2021 in a slash and sell move.

The empire also owned a farm whose managers sought to evict Indigenous Peoples from land they claim their own.

Brookfield’s involvement in deforestation and human rights abuses contrast with its own environmental, social and governance (ESG) policy and Mr Carney's public image.

“We operate with the highest ethical standards, conducting our business with integrity,” Brookfield wrote in its latest annual report.

But Brookfield’s owner-operator-investor model means it could have profited three times from forest destruction in Brazil – from the sale of commodities, from the sale of financial instruments derived from these commodities and from fluctuations in the price of its resale assets such as farms.

Brookfield and its biggest banking backers, HSBC, Deutsche Bank and Bank of America, signed up to the Glasgow Financial Alliance for Net Zero (GFANZ) in April 2021.

The alliance commits its signatories to taking immediate action to reach net zero greenhouse gas emissions by 2050.

Yet deforestation on Brookfield farms released an estimated 600,000 tonnes of CO2 in the nine years to June 2021, destroying parts of a crucial carbon sink and biodiversity hotspot.

In September, GFANZ leaders, including Mr Carney, wrote to members urging them to stop financing deforestation, warning "the world will not reach net zero by 2050 unless we halt and reverse deforestation within a decade."

At that point, all GFANZ members were required to follow criteria set by the UN's Race to Zero campaign to "ensure credibility and consistency," including achieving deforestation-free supply chains by 2025.

However, in late October 2022, GFANZ announced it was no longer mandatory for its members to adhere to Race to Zero targets.

This happened shortly before Race to Zero planned to introduce independent monitoring controls with the power to evict non-performing financial institutions from the alliance, raising questions about the willingness of GFANZ members to be held accountable to their pledges.

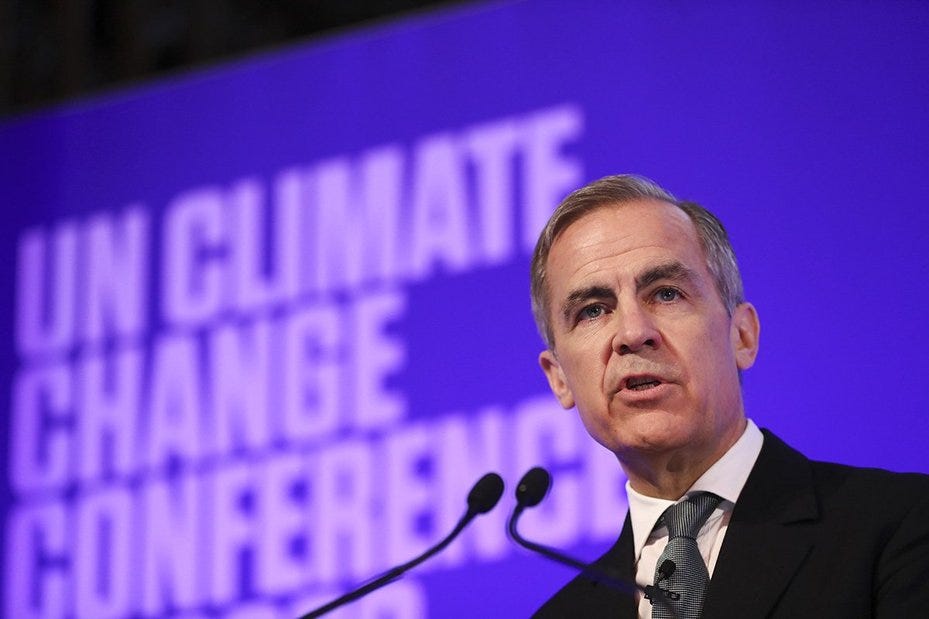

Mark Carney, former governor of the Bank of England, speaks at the launch of the COP26 Private Finance Agenda in 2020 in London.Bloomberg / Getty

Mark Carney is one of the founders and public faces of GFANZ and has been Head of Transition Investing at Brookfield since August 2020.

The deforested farms were sold off in 2021 and Carney was promoted from Vice Chair to Chair of the firm in December 2022.

Mr Carney was appointed special adviser to then-Prime Minister Boris Johnson for COP26 in January 2020, and he has been a UN Special Envoy on Climate Action and Finance since 2019.

Brookfield faces allegations of clearing trees from climate-critical forest land to make way for cash crops while seeking to evict Indigenous Peoples from the heart of the Amazon to make way for cattle and mining opportunities.

A ranch which Brookfield attempted to sell in January 2022, after the asset was frozen by a local court, battled for years to evict an endangered Indigenous community from their ancestral land.

And in another alleged human rights abuse, a firm controlled by Brookfield was fined R$800,000 ($163,000) in December 2021 for slave labour offences at a different farm.

Brookfield’s deforested farms were controlled through a network of investment funds and subsidiaries linked to the asset manager’s entities based in Toronto, Bermuda and London, some of which were sold off in 2021.

Some of the soy produced in the properties that contained deforestation were sold to the controversial commodity trader Cargill, a company exposed many times for its links to forest clearance, and subsequently could have found its way into British supermarket chicken.

At least two British financial institutions, the Lancashire County Council Pension Fund and the London Pension Funds Authority, have invested directly in Brookfield’s Brazilian agricultural fund.

Soy warehouse in Mato Grosso state, Brazil. Brazil is the second largest soy producer worldwide. Paulo Fridman / Corbis via Getty Images

Brookfield’s “slash and sell” tactics should not absolve it from responsibility for the environmental abuses committed on its farms.

Its ability to cash in on deforestation underlines the need for governments to legislate to stop the financing of forest destruction, rather than relying on voluntary net zero initiatives such as GFANZ.

In response to these allegations, the company said it “unequivocally refute[s] the specific allegations made by Global Witness – Brookfield has always acted in accordance with all applicable laws and regulations.

"Brookfield is committed to the highest standards of ethical behaviour across all our global investments, and we move quickly to address issues when they arise.

"We have been invested in Brazil for over one hundred years and we have been proud to support the country build and operate vital infrastructure. While we are no longer active in farming, timber or mining in Brazil, we continue to operate assets in a range of sectors and we look forward to continuing supporting the country on its development towards a Net Zero and thriving economy.”

Brookfield Asset Management (BAM) indirectly controlled each farm named in this report, through Brazilian investment funds and subsidiary companies. Where the name “Brookfield” is used in the report this refers either to the Toronto headquartered BAM, to the Rio de Janeiro-headquartered company Brookfield Brasil Ltda, which BAM held a majority stake in via Brookfield Participacoes and Brkb Participacoes II, or to Brookfield Agricultural Group, the brand name used by Brookfield Brasil in some cases. The relationships between firms in the Brookfield corporate umbrella named in this report is detailed in Annex C (please see the PDF version of the report for details).

This is the 2nd part of the Global Witness report.

Mark Carney firm offloaded farms linked to deforestation and human rights abuses in hypocrisy-ridden 'slash and sell' strategy

Published: 16 December 2022

As a senior figure in the leadership of Brookfield Asset Management, the UN’s Special Envoy for Climate Action and Finance, Mark Carney, oversaw the offloading of land deforested by the company that is also linked to human rights abuses, and "slave-labour like" working conditions, despite his own assertions that companies should rectify environmental damage before selling off.

Between 2012 and 2021, 9,000 hectares of forest, across eight Brazilian farms - equivalent to the size of 11,000 football pitches - was deforested by Brookfield to make way for soybean production. In addition to this deforestation - responsible for an estimated release of as much carbon dioxide as 1.2 million flights between London and New York - Brookfield’s farming operations were linked to the attempted eviction of an indigenous community, and breaches of laws against slave labour in the Cerrado.

Carney joined the company in 2020, following his tenure as Governor of the Bank of England, and oversaw the sale of these lands as Vice Chair and Head of Transition Investing. Carney has since been promoted to Chair of Brookfield’s asset management division. Brookfield has not publicly stated how much it received for the sale of these lands.

Selling off of these controversial farms stands in stark contrast with recent comments made by Mark Carney to British MPs in which he called on companies with environmentally damaging assets to be obliged to mitigate that damage before selling them.

Speaking to the UK Parliament’s Environmental Audit Committee, he said, “In many respects the easiest thing for an institution to do if they have exposure in an emerging economy to coal or something like that… is to sell it, is to walk away. What we’re looking to do, and we would like to be backed on this as opposed to attacked, is to have responsibility for the institution to have a managed phase out.” Carney reiterated this view at COP27 when discussing deforestation, saying, “You have to have ownership of the problem. Don’t divest your way out of the problem.”

Veronica Oakeshott, Forests Campaign Leader at Global Witness, said:

“We couldn’t have put it any better than Carney has done himself. Brookfield should have restored the forest it destroyed and compensated the community that lived under the threat of eviction for years. Simply walking away from a trail of destructive environmental and social impact, having profited from it, is not responsible, not ethical, and not the positive climate action required.”

“Despite the company’s great wealth and Carney’s championing of climate causes, Brookfield has fundamentally failed to avoid contributing to climate destruction. Companies’ green credentials, and those of climate champions, will rightly be judged on the action they take rather than just the words they say.”

Slash and Sell, the new report from Global Witness, used satellite imagery from Brazil’s space institute to identify the scale of forest clearance from 2012-21 on land owned by Brookfield. It found:

Across eight farms owned by Brookfield in the Cerrado region, an area of forest the size of 11,000 football pitches was cleared for soybean production. This helped to destroy a crucial carbon sink and biodiversity hotspot, releasing an estimated 600,000 tonnes of CO2 into the atmosphere - equivalent to 1.2 million flights from London to New York.

Brazilian state authorities produced documentary evidence that Brookfield had the legally required permit to carry out deforestation activity for only one of the eight farms.

A Brookfield-controlled firm was fined $800,000 for slave labour offences at one of these farms, in a ruling upheld by a regional labour court in December 2021.

Besides this environmental damage, Brookfield’s farming operations have been linked to the attempted eviction of indigenous people from their lands in the Amazon.

In addition to his role with Brookfield, Carney is the UN’s Special Envoy on Climate Action and Finance and was the UK Government’s lead advisor during COP26 last year in Glasgow. Carney is also the founder and co-Chair of the Glasgow Financial Alliance for Net Zero (GFANZ), which has urged its members to stop financing deforestation. Recent analysis by Global Witness found GFANZ asset managers and owners still hold investments worth $8.5 billion in companies exposed to deforestation despite their net zero pledges.

Carney’s employer, Brookfield, and its biggest banking backers HSBC, Deutsche Bank and Bank of America, all signed up to the Glasgow Financial Alliance for Net Zero (GFANZ) in April 2021.

Oakeshott added:

”Protecting forests is an essential part of protecting the climate. If a company led by green finance champion, Mark Carney, is getting this wrong, it shows the current system of trusting companies to do the right thing on climate, including deforestation – a system which Carney himself leads through the Glasgow Financial Alliance for Net Zero - has well and truly failed.

“The experiences of Brookfield and the troubled alliance, GFANZ, is evidence that governments must act if we want to have any forests left standing at all. This requires legislation that outright stops investors contributing to the demolition of rainforests.”

Global Witness is calling for new laws to ensure international investors conduct due diligence to prevent them from knowingly bankrolling companies responsible for forest destruction, including through an amendment to the Financial Services and Markets Bill moving through the UK Parliament now. Last week, the EU agreed to landmark legislation to prevent the import of commodities grown on deforested land, and committed to evaluate the role of European financial institutions in driving global deforestation.

You can download the 36 page pdf Global Witness report below.

Related post: